Auto Insurance Companies: Top Rated Providers

The search for the perfect auto insurance company can be a daunting task, with numerous providers vying for your attention. As a responsible driver, you want to ensure that you’re covered in case of an unforeseen accident or incident. But with so many options available, it’s essential to separate the best from the rest. In this article, we’ll delve into the world of auto insurance, exploring the top-rated providers, their unique features, and what sets them apart from the competition.

To begin with, let’s examine the key factors that contribute to an auto insurance company’s reputation. These include financial stability, customer service, claims handling, and policy options. A company’s financial stability is crucial, as it directly impacts its ability to pay out claims. Customer service is also vital, as it can make or break the overall experience. Claims handling is another critical aspect, as it can be a stressful and overwhelming process. Finally, policy options are essential, as they allow drivers to tailor their coverage to suit their specific needs.

With these factors in mind, let’s take a look at some of the top-rated auto insurance companies in the industry.

Top-Rated Auto Insurance Companies

- State Farm: As one of the largest auto insurance providers in the country, State Farm boasts an impressive network of agents and a wide range of policy options. Their exceptional customer service and robust financial stability make them a popular choice among drivers.

- Geico: Geico is known for its competitive rates and user-friendly online platform. Their policies are highly customizable, and their claims handling process is streamlined for efficiency. With a strong financial foundation and excellent customer service, Geico is a top contender in the auto insurance market.

- Progressive: Progressive is a pioneer in the auto insurance industry, offering innovative features like usage-based insurance and a comprehensive online platform. Their customer service is highly rated, and their claims handling process is designed to be quick and hassle-free.

- Allstate: Allstate is a well-established provider with a strong reputation for financial stability and excellent customer service. Their policies are highly customizable, and their claims handling process is built around the needs of their customers.

- USAA: USAA is a unique provider that caters exclusively to military personnel and their families. Their auto insurance policies are highly rated, with exceptional customer service and a streamlined claims handling process.

Comparative Analysis: Policy Options and Pricing

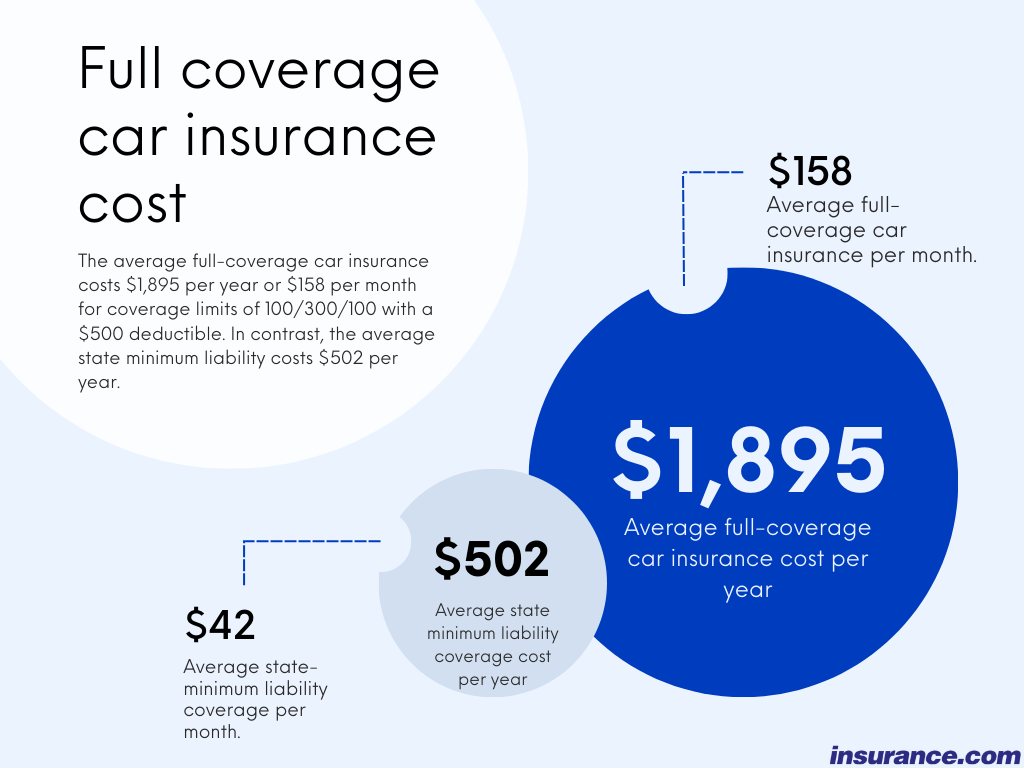

When it comes to policy options and pricing, each provider has its strengths and weaknesses. State Farm and Allstate offer a wide range of policy options, including comprehensive coverage, collision coverage, and liability coverage. Geico and Progressive, on the other hand, focus on providing competitive rates and innovative features like usage-based insurance.

In terms of pricing, Geico and Progressive tend to offer lower rates, especially for drivers with good credit and a clean driving record. State Farm and Allstate, while slightly more expensive, offer more comprehensive coverage options and a stronger reputation for financial stability.

Expert Insights: What Sets the Top-Rated Providers Apart

To gain a deeper understanding of what sets the top-rated providers apart, we spoke with industry experts and examined customer reviews. According to the experts, the key to a top-rated provider is a combination of financial stability, excellent customer service, and a streamlined claims handling process.

“The top-rated providers have a deep understanding of their customers’ needs,” says one expert. “They offer flexible policy options, competitive rates, and exceptional customer service. They also have a strong financial foundation, which gives drivers peace of mind knowing that their claims will be paid out quickly and efficiently.”

Problem-Solution Framework: Overcoming Common Challenges

One of the most common challenges drivers face when searching for auto insurance is navigating the complex landscape of policy options and pricing. To overcome this challenge, it’s essential to do your research and compare rates from multiple providers.

Another challenge is finding a provider that offers excellent customer service and a streamlined claims handling process. To address this, look for providers with a strong reputation for customer service and a proven track record of handling claims efficiently.

Historical Evolution: The Development of Auto Insurance

The auto insurance industry has undergone significant changes over the years, from its humble beginnings to the complex landscape we see today. In the early days, auto insurance was a relatively simple concept, with providers offering basic coverage options and minimal customer service.

As the industry evolved, providers began to offer more comprehensive coverage options, including collision coverage, comprehensive coverage, and liability coverage. They also invested heavily in customer service, recognizing the importance of building strong relationships with their customers.

Future Trends Projection: The Impact of Technology on Auto Insurance

As technology continues to advance, the auto insurance industry is likely to undergo significant changes. One of the most significant trends is the rise of usage-based insurance, which allows drivers to pay rates based on their actual driving habits.

Another trend is the increasing use of artificial intelligence and machine learning to improve customer service and claims handling. Providers are also investing in online platforms and mobile apps, making it easier for drivers to manage their policies and access important information.

Technical Breakdown: Understanding Policy Options and Coverage

When it comes to policy options and coverage, it’s essential to understand the nuances of each provider’s offerings. Comprehensive coverage, for example, covers damage to your vehicle that’s not related to a collision, such as theft or vandalism. Collision coverage, on the other hand, covers damage to your vehicle in the event of an accident.

Liability coverage is also crucial, as it covers damages to other vehicles or property in the event of an accident. Finally, personal injury protection (PIP) coverage provides medical coverage for you and your passengers, regardless of who’s at fault.

Resource Guide: Tips for Finding the Best Auto Insurance Provider

Finding the best auto insurance provider requires careful research and comparison. Here are some tips to help you get started:

- Compare rates: Get quotes from multiple providers to find the best rate for your needs.

- Check policy options: Look for providers that offer flexible policy options and comprehensive coverage.

- Evaluate customer service: Read reviews and ask friends and family about their experiences with different providers.

- Assess financial stability: Check the provider’s financial ratings and reputation for paying out claims efficiently.

- Consider innovative features: Look for providers that offer usage-based insurance, online platforms, and mobile apps.

Step-by-Step Guide: How to Choose the Right Auto Insurance Provider

Choosing the right auto insurance provider involves several steps:

- Determine your needs: Assess your driving habits, vehicle type, and coverage requirements.

- Research providers: Compare rates, policy options, and customer service from multiple providers.

- Evaluate financial stability: Check the provider’s financial ratings and reputation for paying out claims efficiently.

- Consider innovative features: Look for providers that offer usage-based insurance, online platforms, and mobile apps.

- Read reviews and ask for referrals: Get insights from friends, family, and online reviews to help you make a decision.

FAQ Section

What are the most important factors to consider when choosing an auto insurance provider?

+The most important factors to consider when choosing an auto insurance provider include financial stability, customer service, claims handling, and policy options. You should also consider the provider's reputation, pricing, and innovative features.

How do I compare auto insurance rates from different providers?

+To compare auto insurance rates from different providers, you should get quotes from at least three providers and compare their rates, policy options, and coverage. You should also consider factors like customer service, claims handling, and financial stability.

What are the benefits of usage-based auto insurance?

+The benefits of usage-based auto insurance include lower rates for safe drivers, more accurate pricing, and the ability to track your driving habits. This type of insurance also encourages safe driving habits and can help you save money on your premiums.

How do I file a claim with my auto insurance provider?

+To file a claim with your auto insurance provider, you should contact their claims department as soon as possible after an accident or incident. You'll need to provide details about the incident, including the date, time, and location, as well as any relevant documentation, such as a police report or photos of the damage.

Can I customize my auto insurance policy to fit my specific needs?

+Yes, most auto insurance providers offer customizable policy options that allow you to tailor your coverage to fit your specific needs. You can choose from a range of coverage options, including comprehensive coverage, collision coverage, and liability coverage, as well as add-ons like roadside assistance and rental car coverage.

By following these tips and considering the top-rated auto insurance providers, you can make an informed decision and find the best coverage for your needs. Remember to always compare rates, evaluate policy options, and assess financial stability before making a decision. With the right provider and policy, you can drive with confidence, knowing that you’re protected in case of an unforeseen accident or incident.