Direct Parent Plus Loan Eligibility Explained

The Direct Parent PLUS Loan is a type of federal student loan that enables parents to borrow money to cover the educational expenses of their dependent undergraduate students. These loans are part of the Federal Direct Loan Program, which is managed by the U.S. Department of Education. Understanding the eligibility criteria and the application process for Direct Parent PLUS Loans is essential for parents seeking to finance their child’s higher education.

Basic Eligibility Requirements

To be eligible for a Direct Parent PLUS Loan, certain conditions must be met:

Borrower Eligibility: The borrower must be the biological or adoptive parent of the student. In some cases, stepparents may also be eligible if they are married to the student’s parent at the time of application. Legal guardians and grandparents are generally not eligible to borrow under this program.

Student Eligibility: The student must be a dependent undergraduate student enrolled at least half-time in a degree-granting program at an eligible school.

Citizenship and Residency: Borrowers must be U.S. citizens or eligible non-citizens, and they must not be in default on any federal education loans or owe an overpayment on a federal education grant.

Credit Check: A critical requirement for obtaining a Direct Parent PLUS Loan is passing a credit check. The Department of Education checks the borrower’s credit history to determine if they have an adverse credit history, which could make them ineligible for the loan.

Master Promissory Note (MPN): Borrowers must sign a Master Promissory Note (MPN), a legal document in which they promise to repay the loan and any accrued interest.

Application Process

Applying for a Direct Parent PLUS Loan involves several steps:

Filing the FAFSA: The first step in applying for any federal student aid, including the Direct Parent PLUS Loan, is for the student to complete the Free Application for Federal Student Aid (FAFSA). The FAFSA helps determine the student’s eligibility for federal, state, and institutional financial aid.

Checking Eligibility: After the FAFSA is processed, the student’s school will notify them about their eligibility for federal student aid, including the maximum amount they can borrow through the Direct Parent PLUS Loan program.

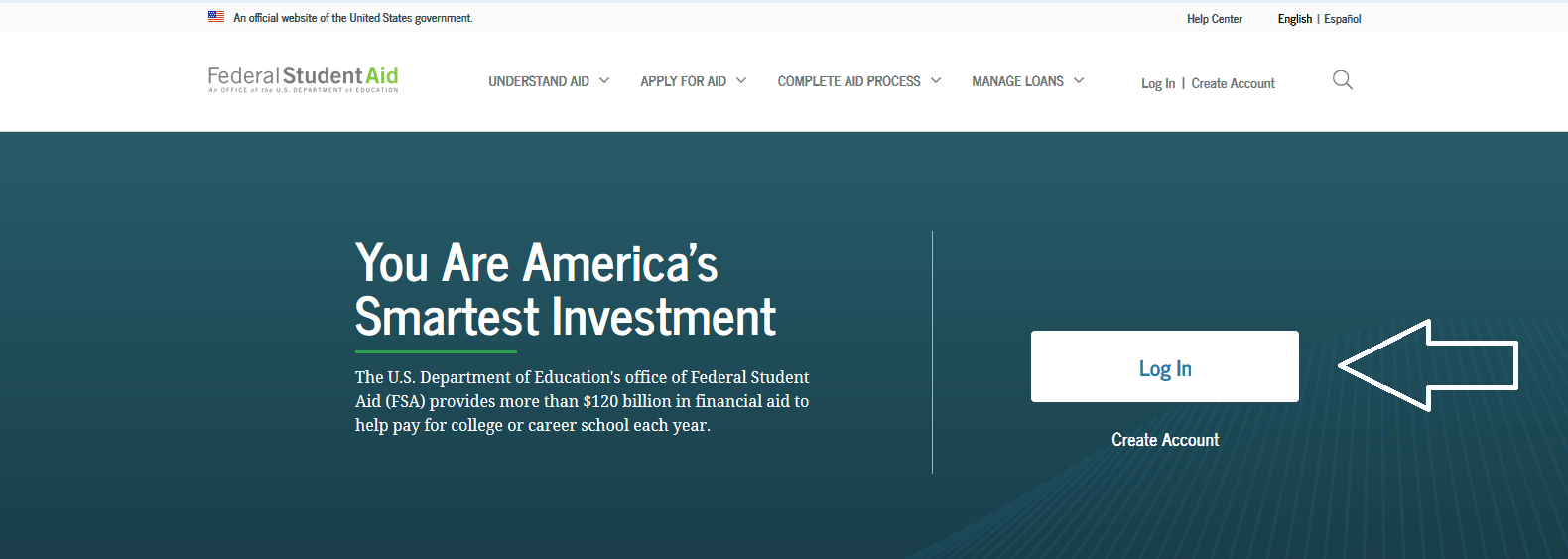

Applying for the Loan: If the parents decide to borrow a Direct Parent PLUS Loan, they will need to apply for the loan at studentaid.gov. This involves logging in with their FSA ID, selecting the “Apply for a Direct PLUS Loan” option, and following the prompts to complete the application.

Credit Check: As part of the application process, parents will undergo a credit check to determine their eligibility.

Signing the MPN: If the loan is approved, parents will need to sign a Master Promissory Note (MPN) agreeing to the terms of the loan.

Repayment and Interest

It’s essential for parents to understand the terms of the Direct Parent PLUS Loan, including how interest accrues and when repayment begins:

Interest Rate: The interest rate for Direct Parent PLUS Loans is fixed but may change annually. It’s crucial to check the current rate when applying for the loan.

Fees: There’s a loan fee on all Direct Parent PLUS Loans, which is deducted from the loan amount before the funds are disbursed to the school.

Repayment: Repayment typically begins immediately after the loan is fully disbursed, and parents have various repayment plan options to choose from, including the option to defer payment while the student is in school.

Conclusion

Direct Parent PLUS Loans provide an essential funding option for many families, helping bridge the gap between the cost of attending college and other forms of financial aid. While eligibility is subject to certain conditions, particularly the creditworthiness of the borrower, the loan offers flexibility and competitive terms. Understanding the eligibility criteria, application process, and terms of repayment is vital for making informed decisions about financing a child’s education.

What is the minimum credit score required for a Direct Parent PLUS Loan?

+The U.S. Department of Education does not use a specific credit score to determine eligibility for a Direct Parent PLUS Loan. Instead, the borrower must not have an adverse credit history, which means they cannot have certain negative marks on their credit report, such as bankruptcy, foreclosure, or defaulted loans.

Can I still get a Direct Parent PLUS Loan if I have a bad credit history?

+If you have an adverse credit history, you may still be eligible for a Direct Parent PLUS Loan by obtaining an endorser who does not have an adverse credit history. An endorser is someone who agrees to repay the loan if you do not. Alternatively, you may also be eligible if you can document extenuating circumstances related to your adverse credit history.

How much can I borrow through the Direct Parent PLUS Loan program?

+The amount you can borrow through the Direct Parent PLUS Loan program is the cost of attendance at the student's school minus any other financial aid the student receives. The school determines the cost of attendance and the maximum loan amount.

In navigating the complex landscape of financial aid for higher education, parents must carefully consider their eligibility for and the implications of borrowing through the Direct Parent PLUS Loan program. By understanding the details of this loan option, families can make more informed decisions about financing their child’s educational journey.